words by Wangui Kariuki

Managing money is one of the most crucial markers of adulthood. You are magically expected to have it figured out, even with limited tools and few candid conversations. Over the last 2 years I have spent time building systems & habits behind my financial plan to make sure it works efficiently and effectively to meet my needs. I’ve listened to hours of financial literacy content, said goodbye to thinking short term & overspending on weekend enjoyment and learned to have honest conversations with myself (& others) about what role money plays in my life. I’d like to give you a glimpse into annual, quarterly and weekly habits I have picked up along the way that have helped me go from only knowing how to save to investing with a plan in 2 years.

Every year I create the skeleton of my master plan…

One thing you should know about me right off the bat, is I am a lady of enjoyment. I instantly unsubscribe from financial approaches that focus on penny pinching or telling you to cut back on coffee. You will 100% find me at Java 2 – 3 times a week enjoying a piping hot cup of masala tea. So when I am creating my financial plan I focus heavily on how I can use my money to achieve my goals now and in the future. Before 2020, I used to have a very short-term view of money, often planning a month at a time, shifting my perspective & even thinking about retirement has been transformational. Here are some steps I take to create my master plan:

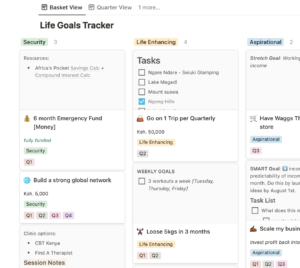

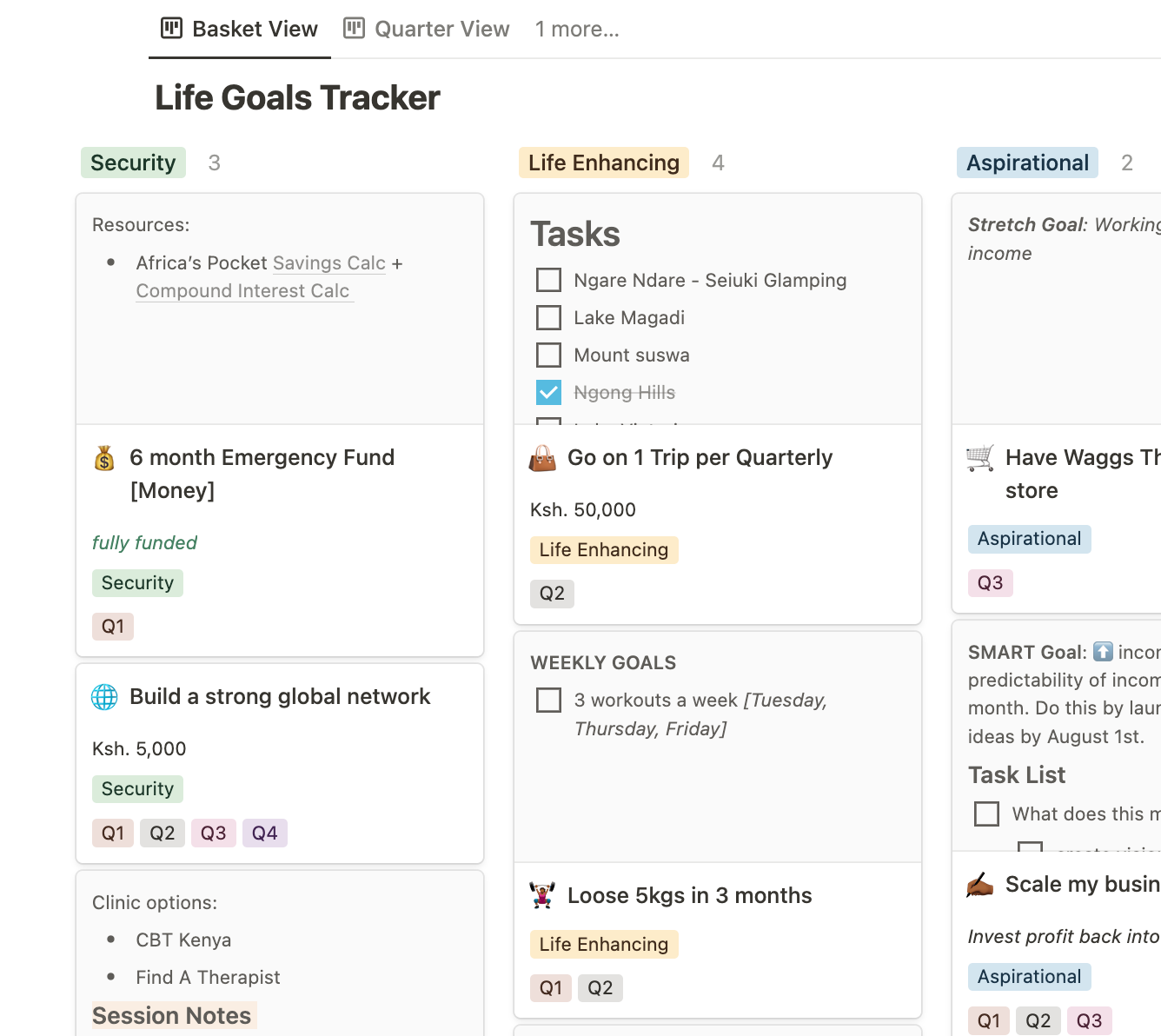

- Create a prioritized list of my goals: In January I ride the new year wave & think about what kind of year I want to have. I focus on what kind of person I want to be & pay attention to recurring thoughts or ideas I have. I then categorize the goals based on when I want to achieve them, and what role they play in my life. This is an important first step, because as I mentioned earlier, I use my money to fuel these goals. I’ve found this helps me stay consistent in the long-run because I am working towards things I actually want. (i.e. the difference between I want to save KES. 400,000 vs. I want to save KES. 400,000 to travel to the UK for my best friends graduation in December)

- Make the first 3 months goals practical: I use the SMART framework to make my goals tangible. I spend time breaking down each goal to understand what it really takes to achieve it. How much will it cost? How much time do I have or need? Do I need support or is someone else involved? What do I need to do before I can achieve this goal? This can be overwhelming, so I do this in chunks & over the course of a week. Find a fun music playlist, or invite some friends over for a vision boarding session to get step 1 & 2 done.

- Automate my savings & investments to fuel these goals: This is where the magic happens. I use standing orders from my checking to my Money Market Fund to make sure I am saving towards my goals even when I don’t remember or feel like it. This is a very important step because it minimizes room for error & keeps me on track every month. Imagine if you could automate your workouts so make sure you didn’t need willpower to go to the gym? Well that’s exactly what this feels like.

I built a goal setting dashboard that has become the backbone of tracking my financial plan. If you’d like the template click here. (Use discount code TEREMBE to get $$ off)

Every quarter I reflect & refresh…

Some people do this monthly, but I tend to do this in depth every 3 months because life just moves at the speed of light & like Ramit (a financial coach I am kind of obsessed with) says “I would rather be eating tacos than spending hours on my finances each month”. Find a system that works for you, I am just here to show you that managing your money doesn’t have to be a long stressful & inaccessible process. To reflect & refresh I:

- Look back at the last 3 months & figure out what didn’t work: This is an opportunity to nip mistakes at the bud or improve on something that I wasn’t happy with. Tweaking and adjusting helps me make sure I am still moving towards the things I want. Sometimes I tweak my goals, or my process, or the amount I am putting towards a long-term goal. I like to think of my financial plan like a living breathing thing, not a set of rules set in stone.

- Adjust existing or try out new processes to reach your goals: I used a new ideology to reflect & refresh my plan last quarter- coined a Conscious Spending Plan by Ramit Sethi. I love it because it reframes traditional budgeting by focusing on the future, and helps you build a plan to spend money on the things you want! As someone who likes to spend, I like this approach a lot because it teaches you how to think about where you want your money to go & gives you a structure on how to get there. Plus I just love the psychological reframe!

Every week I spend time learning & spending my money guilt free…

I love learning about new ways to do or think about things. I am a sucker for a thought-provoking conversation & love to learn from people’s experiences. I spend a lot of time talking to people about money, learning about how they approach their finances, what they worry about, what they wish was more accessible (information, resources, etc). I also spend a lot of time listening to podcasts, reading articles & taking courses to help breathe new life into my financial plan. Continuously learning (& doing) has been instrumental in helping me: save a 6 month emergency fund, invest KES. 1,000,000 in government bonds, move out & fully furnish my apartment, and build a travel fund so that I can #TembeaKenya (& the globe- soon come). As a believer in sharing, here are some resources that I keep going back to learn from:

- Africa’s Pocket – A wealth building platform (built for Africans by Africans) where you can learn about, plan for & act on your finances. I’ve worked here for 2 years now & this is where I truly started to understand why tying your goals to your money is revolutionary. I have taken courses & managed to build my portfolio with clarity that my money is fueling my best life.

- “I Will Teach You To Be Rich” Podcast by Ramit Sethi – He has raw, unfiltered conversations with couples about money & helps them understand the root of their limiting beliefs, so they can build a rich life.

- CNBC Make It Millenial Money Series (YouTube Channel) – They share stories of how Millenials earn, save & spend their money.

Brunch with my bestie #GuiltFreeSpending

The TLDR (too long; didn’t read)

If you only take away two things from this article, I’d love for you to leave with these thoughts that helped affirm me along the way:

- With the right systems, it is possible to use your money to fuel your goals

- You can (& should) build a financial plan that doesn’t shame you for spending money on things that make you happy

I’d love to know … what are some things you want to be able to spend money on guilt free?

Wangui Kariuki is a data analyst, designer and environmental economist who spends a lot of time thinking about human behavior and how to build sustainable systems. She currently works at Africa’s Pocket where she brings her skills together to design & inform the customer experience by advocating for users needs. She also runs a digital illustration business (@waggstheartist) where she explores creativity & personifies the beauty of diversity and nature, and is a plant mum of 4.

5 Comments

Hi Terembe, this right here is a piece everyone needs to read. Thoroughly enjoyed reading this.

Thank you very much! Definitely agree, please do share it with someone who you think should read it.

Such kind words Brenda 🙂 thanks!

I’d love to connect & hear about what resonated with you

[…] September 15, 2022 […]

[…] September 15, 2022 […]